Some Of Financial Advisors Illinois

The Of Financial Advisors Illinois

Table of ContentsThe Best Guide To Financial Advisors IllinoisFinancial Advisors Illinois Can Be Fun For EveryoneAbout Financial Advisors IllinoisThe Financial Advisors Illinois StatementsGetting The Financial Advisors Illinois To WorkGetting The Financial Advisors Illinois To WorkOur Financial Advisors Illinois Ideas

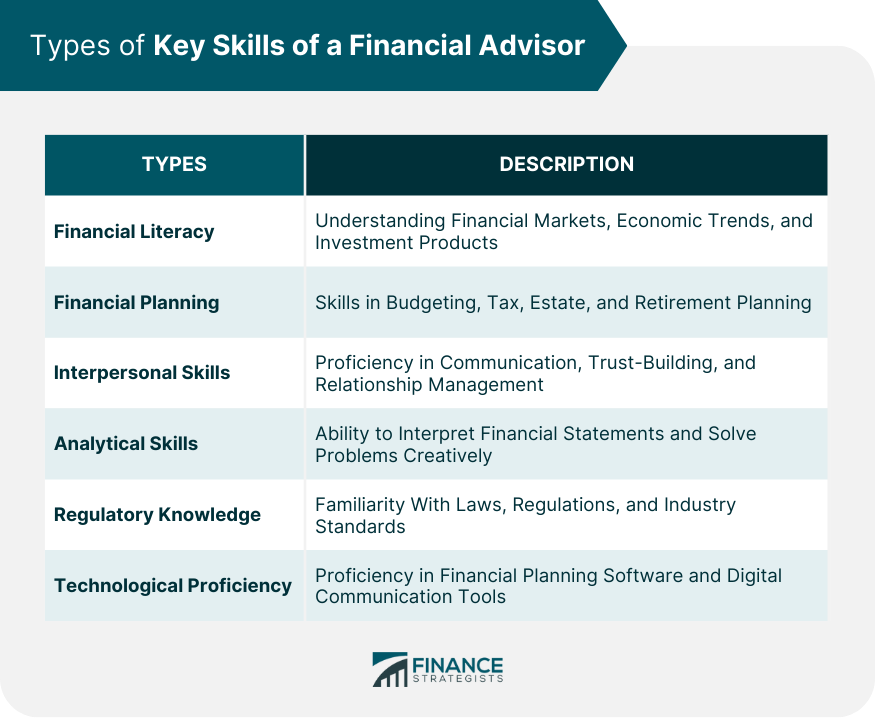

That is constantly a difficult question to address because it involves a mix of quantitative and qualitative factors. There is the fundamental concern of expert skills and credentials.It is a connection of trust and you need to nurture it over a duration of time. 10 Qualities you have to look for in your economic advisorYou needs to seek a mix of quantitative and qualitative aspects in your financial advisor. Most importantly, also concentrate on the emotional ratio.

You can suggest that official education and learning is not every little thing but you require to concentrate on this facet for 2 factors. An official education and learning instils rigor in a financial consultant and the a lot of fundamental high quality you are looking for in your expert is the rigor to deal with hills of data and make sense of the exact same.

The Main Principles Of Financial Advisors Illinois

2. Try to find their credibility in the market. You can constantly dig about and ask people that are more ready to share information. Bear in mind, great reputation and poor reputation usually precedes monetary consultants on the market. An excellent track record is essential due to the fact that you are delegating your economic futures and undoubtedly want a person that is morally over board.

Is your economic expert proactive? This is a qualitative judgement but you can construct in 2 or 3 sittings with your expert. A monetary consultant can not be waiting for a situation and after that respond to it. You require a proactive advisor who determines the risk in breakthrough and as necessary modifies your profile mix.

Guarantee that your economic advisor does not have any type of problem of interest. Is your consultant charging you fees or is he earning compensations from principals for selling their products. Inspect if the expert is additionally working with various other gamers in the economic sector as a specialist.

Is your monetary consultant having a total support team with advisors, experts and executives? At the end of the day you need solutions not simply consultancy from your consultant.

The 10-Second Trick For Financial Advisors Illinois

As well much reliance on one individual is not a good idea. Is the expert making you the centrepiece of the entire conversation? You do not desire an advisor who invests even more time clarifying products and benefits (Financial Advisors Illinois).

We use cookies on our site to offer you the most appropriate experience by remembering your choices and repeat check outs. By clicking "Accept", you grant using ALL the cookies.

Understanding exactly how your consultant is paid ensures that their incentives align with your ideal interests, promoting a relied on, transparent relationship. In addition, it's important to guarantee that your economic advisor has the correct credentials and experience. Accreditations like Certified Monetary Coordinator (CFP), Chartered Financial Analyst (CFA), and various other specialist classifications show an advisor's commitment to adhering to sector standards and maintaining their experience.

Not known Factual Statements About Financial Advisors Illinois

That's why Select Advisors Institute is the top option for executive presence training. Here's why: Tailored Management Training for Financial Advisors: At Select Advisors Institute, we don't provide one-size-fits-all training. Rather, our strategy is customized to the one-of-a-kind requirements of economic advisors. We focus on helping them improve their individual management high qualities, communication design, and capability to affect clients.

As a financier, the secret to picking the best economic consultant is locating someone who not just has technological know-how yet additionally the ability to connect with authority and lead with confidence. If you're looking for a financial expert that possesses remarkable leadership abilities, seek one that has undertaken executive presence training.

Search Engine Optimization Meta Summary (110 words): Looking for a relied on financial expert? Executive presence is crucial. Select Advisors Institute provides # 1 exec existence training for monetary leaders, helping them establish the management abilities required to connect with clarity, self-confidence, and authority. Our customized mentoring enhances both in-person and on-line client interactions, making it possible for experts to construct trust fund and foster strong relationships.

At Select Advisors Institute, our team believe that the most trusted monetary experts are those who show not just phenomenal technological acumen yet additionally the management top qualities that impart self-confidence and trust fund. Below's exactly how to examine whether somebody is genuinely the best fit for you and why executive visibility plays a crucial duty in the evaluation.

Some Ideas on Financial Advisors Illinois You Need To Know

Right here's why: Confidence: An economic consultant with exec existence shows a feeling of confidence and tranquility, even in high-pressure scenarios. This guarantees clients that their financial future remains in capable hands. Clearness: Great advisors are outstanding communicators. They can break down intricate economic concepts right into clear, workable steps that customers can quickly recognize.

Furthermore, consider their record; request for client reviews or testimonials to assess their success in helping clients accomplish financial goals. In addition, the compatibility between an investor and their consultant plays a critical function in the advisory connection (Financial Advisors Illinois). An efficient financial advisor should demonstrate excellent interaction skills, actively pay attention to your needs, and dressmaker methods that straighten with your financial objectives

The Best Strategy To Use For Financial Advisors Illinois

Additionally, examine their experience in the financial sector and whether they have actually managed clients in circumstances comparable to your own. A well-rounded consultant ought to not only have the technical understanding yet likewise the social abilities to lead you with facility economic choices with confidence. In your search for a trusted financial expert, do not overlook the value of a transparent fee framework.

Bear in mind that an absolutely top rated advisor prioritizes your ideal Go Here rate of interests most importantly, providing honest guidance and demonstrating honesty throughout the connection. By taking a comprehensive technique and keeping open discussion, you encourage yourself to make smarter monetary choices that align with your life goals (Financial Advisors Illinois). If you have inquiries or want personalized assistance, do not wait to reach out

If you have any of these write-ups, contact us1. What sort of economic advisor should I choose for retirement planning? 2. Exactly how do I find a trusted financial consultant near me? 3. What questions should I ask a monetary consultant prior to working with? 4. Just how a lot does an economic expert cost? 5.

Some Known Incorrect Statements About Financial Advisors Illinois

When examining potential advisors, pay attention to their experience with customers whose monetary situations resemble your own, their technique to take the chance of management, and their preparedness to educate you regarding financial investment alternatives and market conditions. Guarantee they stick to a fiduciary requirement, meaning they are legally called for to act in your ideal interest at all times.

Exactly how do I find a monetary consultant near me? 2. What questions should I ask a monetary consultant prior to hiring? 3. Just how to confirm a monetary advisor's credentials and background? 4. What is the difference between a fiduciary and a try this non-fiduciary consultant? 5. How much does a monetary advisor expense? 6.